What an operations management software can bring to remanufacturing workshop?

At Toore, when we first met industrialists from Remanufacturing/Refurbishment, the first thing that struck us was the fact there was no specific tool targeting shopfloor operations.

It seemed counterintuitive since the uncertainty inherent in Remanucturing operations involves a lot of instant and critical decisions for every single item at every stage of the workflow :purchase price, dismantle, cannibalizing, repair, selling grade, distribution channel.... Those decisions could be supported with proper tools leveraging data (or Manufacturing Execution System in the industrial Software jargon).

This is what motivates us to create a spreadsheet model so everyone can simulate the impact of a "proper software", at least financially speaking. We also use this model to check the value we provide to our customers. We keep it up-to-date with the latest feedback from our customers and prospects.

Chased Business metrics

Tackling three main issues leads to three main financial returns :

Profitability : by diminishing the rate of bad decisions like purchasing or repairing non-profitable products and optimizing strategies like dismantling/cannibalization.

Productivity : doing automatic and dynamic steering based on real time shopfloor feedback streamlines workstation communications and saves operators time to focus on products.

Working capital requirements (and opportunity costs !) : Dynamic steering also enables to shrink production lead times and optimize stock management, especially new and used spare parts inventory.

Our model

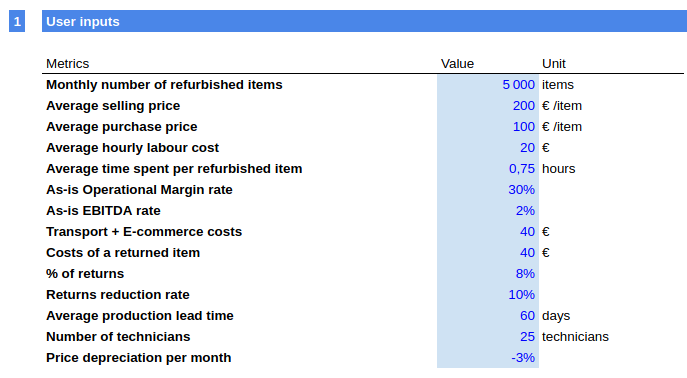

User inputs

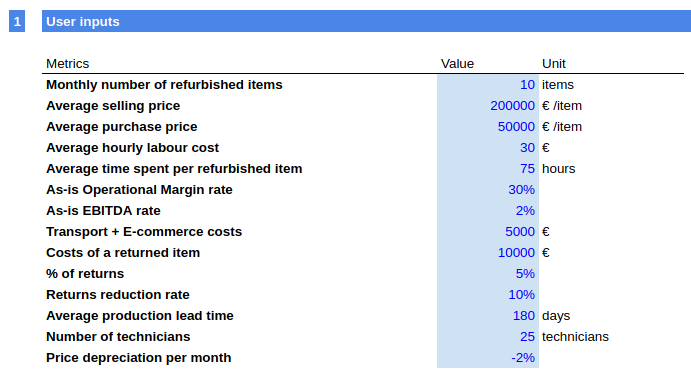

There are around 20 inputs in our model.

The first ones are specific to one's factory or organization.

- the monthly number of processed items, how many items does the factory process on average every month ( we multiply this by 12 to get the full year number)

- The average selling price, by how much do you expect your item to be sold

- The average purchase price, by how much did you buy the item on average

- Average hourly labour cost, of your operation team on the shopfloor

- Average time spent per refurbished item

- As-is Operational Margin Rate, your current (or simulated margin rate) without a software

- As-is EBITDA Rate, you current (or simulated EBITDA rate) without a software

- Transport + E-commerce costs, the cost you have to bear in terms of logistics and to distribute your products

- Costs of a returned item, the cost to transport this item (plus any penality)

- The share of products that are experiencing returns. We saw this ratio going from 3% to 15% depending on the industrialist or the industry

- Returns reduction rate, by how much you think a software can help your technician, quality checks in order to reduce your returns. We let this number be the user's choice, since they know by how far they can improve their quality process.

- Average production lead time, the average duration between the date your product enters the factory and the date it reaches its end state (recycling, sold, dismantled...)

- Number of technicians, or average Full-time Employee on your production site

- Price depreciation per month, by how much your product is losing value on the distribution channel if it is sold one month later. It is compound to get the annual price depreciation, for example, -3% per month, which means -42% in price after 12 months. This number is usually well known by the industrialists. It tends to be quite high for electronics goods (up to -5% per month for some smartphones) and lower for heavy equipment.

Model hypothesis

The other ones are usually less known by our clients/prospects and they are the ones we (at Toore) derived from multiple data sources (interviews, experience with our software, ...)

- Share of operation cost from technician, for example, 12% would mean that from the operational cost, 12% accounts for technician payrolls

- Expected productivity gains, by how much we expect the software to improve the operation throughput

- Production Lead time reduction, by how much we expect to lower the total duration between the date the item enters the factory to the date it reaches its final state (sold, dismantled or recycled)

- Share of repairable products: on average, out of the entering products in the factory, how many are economically repairable? From our observation, this ratio can go from 60/40 to 99/1 depending on the sourcing, and industry,

- Share of non-repairable products, it is the complementary of Share of repairable products

- Decision Error rate, out of 100 decisions you make, how many you do on average. Since it is based on human intuition, we took a conservative 5% on inaccuracy (meaning 95% accuracy).

- Labour costs spent on rejections vs Avg time spent, for instance if it is 10%, it means that rejecting a product takes you 10% of the average time spent per items (for instance 0.75hours, meaning in this example 0.75 x 10%= 7,5% of one hour, eg 4min 30 sec)

- Labour costs spent on non repairable products vs Avg time spent, for instance, if it is 200%, it means that repairing a non-repairable products would take you twice the amount of time compared to the average time spent by item (for instance 0.75hours, meaning 0.75x200%= 1hour and 30 min)

- Error reduction rate, by how much we think we can reduce the inaccuracy with a data-centric approach

- EBITDA rate for non-repairable products, resulting EBITDA when you repair a non-repairable products (for instance -10% means that you won't cover your cost on a non-repairable products, you will lose 10% of its selling price).

- Operations Software expense, per technician, per year. We also use this spreadsheet to compare our pricing vs the Return-on-Investment and the time to breakeven of our solution.

Business cases by industry

Smartphone/IT Hardware

This industry is one of the most mature ones in terms of circularity penetration. IT Refurbishers primary challenge is to handle the volume of the unit, and keeping the quality of their operations at such a high number of items processed per day.

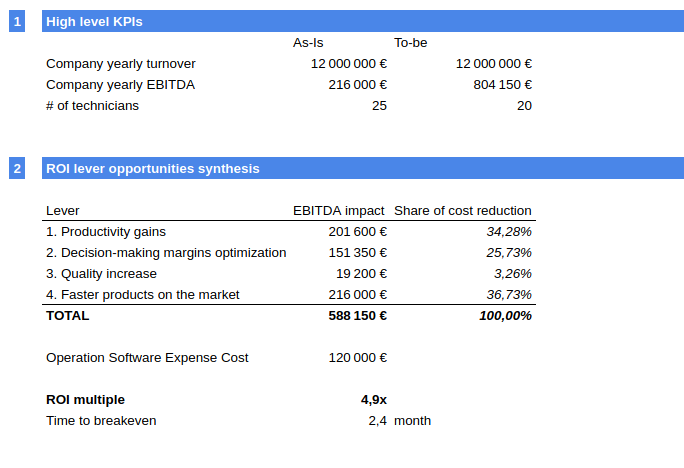

On this example, for a smartphone/IT Hardware refurbisher with a €12M annual revenue.

As you can see the most impacting factor of EBITDA gains is not from direct productivity gains, but the younger products on the market.

An Operation software is also beneficial in terms of cash management with around €300k of Working Capital Requirement reduction

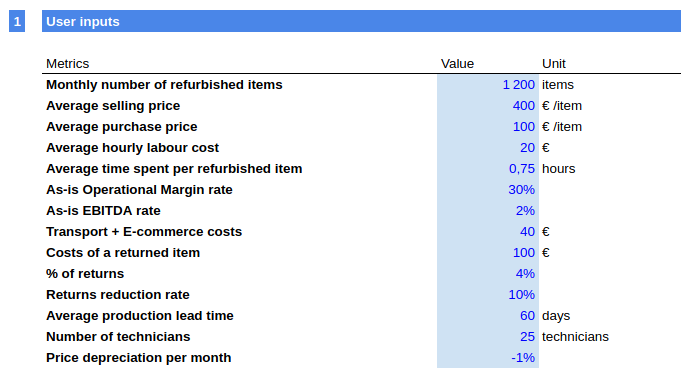

Home Appliances

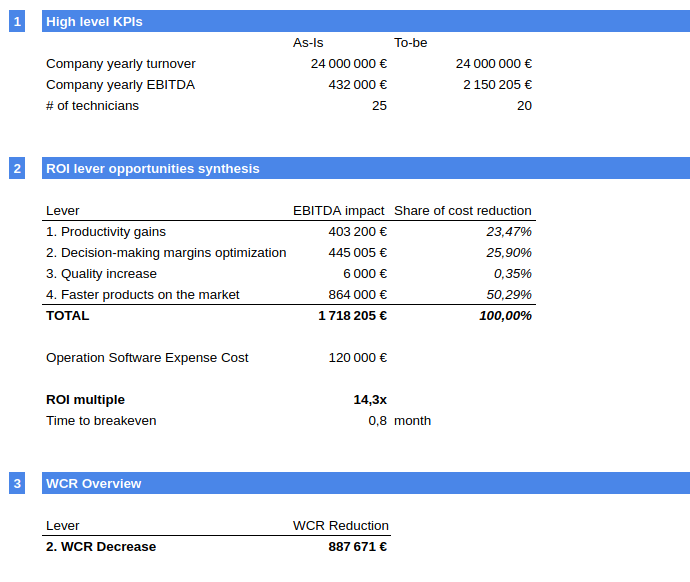

Let’s take the example of a Home Appliance refurbisher, that sells around 14.4k refurbished appliances per year.

The impact of an operation software will mostly come from productivity gains and better decision-making, since products have a lower price depreciation over time.

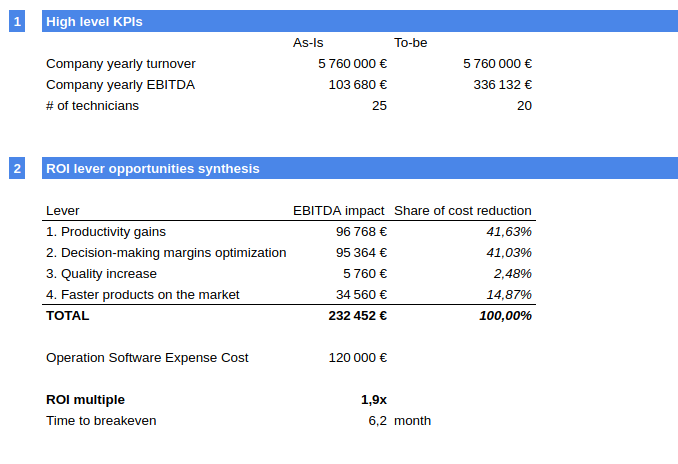

Machinery/Vehicle

This example is on a Machinery Remanufacturer, selling 10 machines per month, with a 200k€ price tag.

The biggest impact for this industrialist would be from faster lead time: the impact is quite sizable both on the Working Capital Requirement (Cash) and on its EBITDA (Profitability).

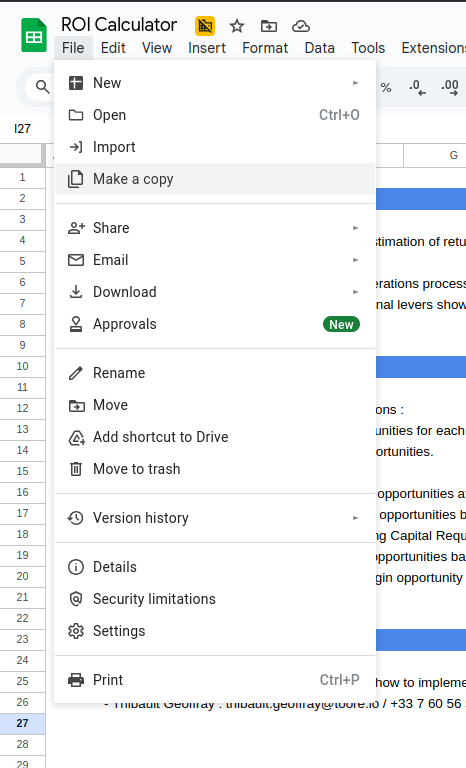

Your turn to play with our tool

From the GoogleSheet link, duplicate locally (it is a template!)

Conclusion

As you saw in this blog post, the impact of a refurbishment operation software is not (only) on productivity gains. Depending on the industry, a better decision-making process and faster lead time can play a huge role towards better profitability and growth!

Fill the Form to unlock the model

Please find here the URL to our Spreadsheet model: Model Gsheet